ventura property tax due date

First day to file affidavit and claim for exemption with assessor but on or before 500 pm. Ventura County collects on average 059 of a propertys.

Due To Covid 19 California County Assessors May Provide Relief For Property Tax Payers Holthouse Carlin Van Trigt Llp

Property taxes not paid on or before December 10 2020.

. PROPERTY TAX DUE DATES. Ad Reduce property taxes for yourself or residential commercial businesses for commissions. Receive Ventura County Property Records by Just Entering an Address.

HOW TO PAY PROPERTY TAXES. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. SECOND INSTALLMENT OF 2020-21 VENTURA COUNTY SECURED PROPERTY TAXES DUE NOW 10 PENALTY PLUS 30 COST ASSESSED AFTER.

Besides counties and districts like hospitals many special districts such as water and sewer. The Ventura County Treasurer-Tax Collector has. In Person - The Tax.

Installment Due Date Delinquency Date Penalty if delinquent First November 1 December 10 10 of amount due Second February 1 April 10 10 of amount due 30 cost When. Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. 189 of home value.

County of Ventura - WebTax - Search for Property. Ventura County 2020-21 Secured Property Taxes are due November 1 2020. Ventura County property taxes due.

Tax amount varies by county. Taxes become a lien on all taxable property at 1201 am. As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID.

Property taxes are the main source of revenue for Ventura and other local public districts. Failure to receive a tax bill does not exempt you from paying taxes and any interest due to late payments per State Statute NJSA. Chronological Listing of Filing Deadlines.

Revenue Taxation Codes. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Ad One Simple Search Gets You a Comprehensive Ventura County Property Report.

Payment Dates for Weekly Payers. 2020-21 VENTURA COUNTY SECURED PROPERTY TAXES DUE NOVEMBER 1 2020 Ventura County 2020-21 Secured Property Taxes are due November 1 2020. Alphabetical Summary of Due Dates by Tax Type.

Reduce property taxes for yourself or others as a legitimate home business. January 1 2021 - December 31 2021. FRAZIER PARKLOCKWOOD VALLEY Monday November 2 2020 at 130 pm.

DUE DATES - Ventura County. Ad Pay Your City Of Ventura CA bill online with doxo. Sunday or legal holiday the delinquency date is the following business day.

Why Did Property Taxes Go Up Almost 400 In Yucca Valley Ca More Details In First Comment Quora

Property Purchase Taxes In India Marketexpress Property Property Tax Cost Sheet

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

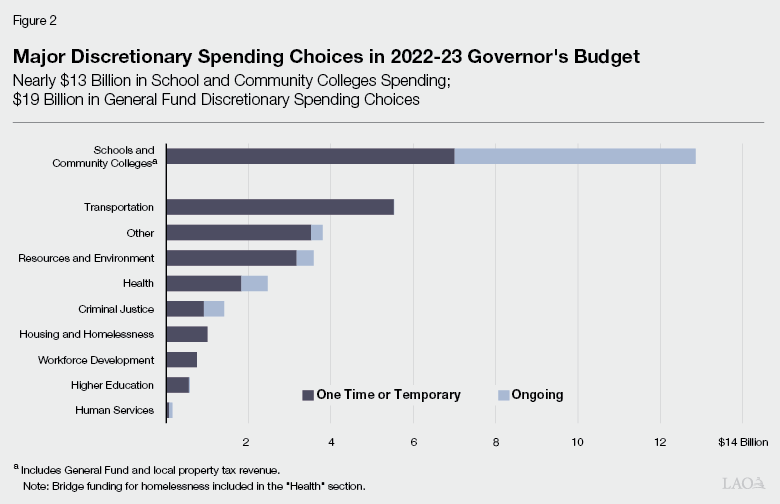

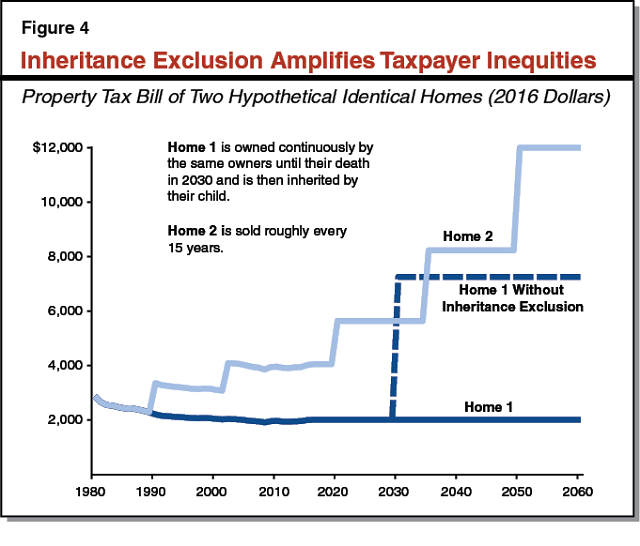

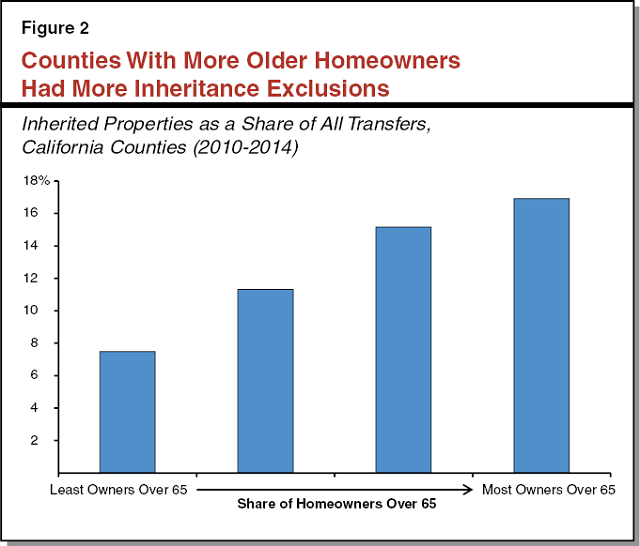

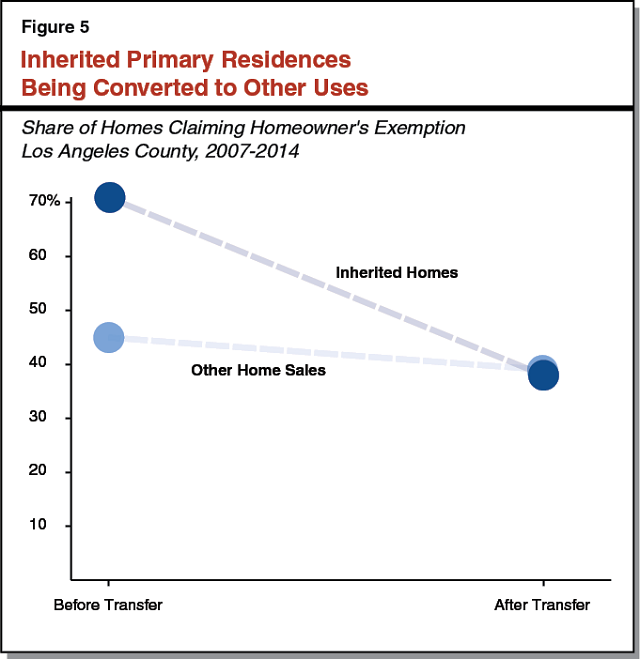

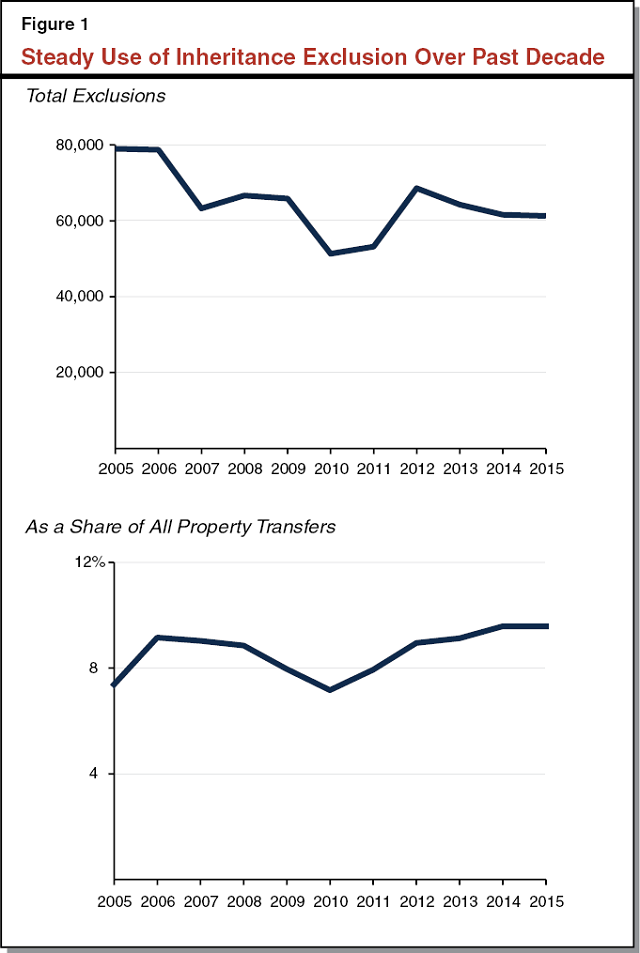

The Property Tax Inheritance Exclusion

Pub 718 F Local Sales And Use Tax Rates On Qualified Motor County Pdf4pro

Pay Property Taxes Online County Of Ventura Papergov

I Use High Yield Savings As Escrow For The Costs Of Homeownership

Well It S Not The Most Interesting Topic Interesting Topics Coding Lecture

The Property Tax Inheritance Exclusion

The Property Tax Inheritance Exclusion

The Property Tax Inheritance Exclusion

The Property Tax Inheritance Exclusion

Pay Property Taxes Online County Of Ventura Papergov

Billi Ortega Tree Trimmer Specialist Treeco Inc Linkedin

California Property Tax Calendar Tax Deadlines